As we move into tax season and the new year unfolds, I want to express my sincere appreciation for the trust you place in BluHawk Wealth Management. Helping you build a secure and purposeful financial future remains the core of what we do, and we’re grateful for the privilege of partnering with you through all market and tax environments.

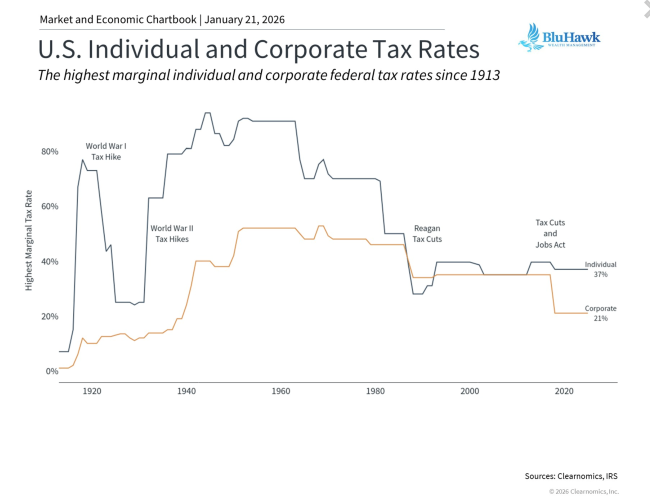

Each year at this time, our focus naturally turns toward taxes, preparing information needed for your returns, organizing documents, and exploring opportunities for tax-efficient planning ahead. Recent changes in federal tax law have added new nuances to this process, particularly around ordinary income, capital gains, and various deduction thresholds.

While thoughtful tax planning remains important, striking the right balance is imperative, and we don’t want minimizing taxes to become the only goal.

Instead, our priority continues to be positioning your wealth in a way that supports durable retirement income and long-term financial resilience.

For many clients who have seen substantial appreciation in after-tax stock positions, this might mean strategically realizing gains soon, at historically favorable capital gains rates, to intentionally seed what we call “Investment Bucket 1.” This very conservative segment of your retirement income strategy is designed to provide peace of mind by locking in future income sources that are less sensitive to market volatility. Filling Bucket 1 can go a long way toward easing concerns that naturally arise when markets cycle lower.

Though we remain cautiously constructive on the current investment landscape, recognizing the potential for continued growth, it’s wise to balance tax efficiency with thoughtful income security.

A lower capital gains tax today can often be preferable to facing potentially higher rates down the road, especially when it helps fund assets earmarked for essential expenses in retirement.

As always, our role is to help you make informed decisions that align with your goals and comfort level. That means actively engaging with you on potential opportunities, modeling outcomes where needed, and ensuring that your financial strategies, including tax considerations, serve your broader lifetime objectives.

Thank you for your continued confidence and engagement.

We look forward to working with you this tax season and beyond, as we pursue not just lower tax bills, but greater financial security and peace of mind for the years ahead.

To conclude, a special added thank you goes out to our valued clients who have so kindly and generously referred to us friends and loved ones in their circle of influence. We recognize that financial discussions of this nature can be delicate and sensitive, and we greatly appreciate the trust and confidence you have placed in us with this gesture.

Rest assured that we will do all we can to continue to take care of you and those you send our way.

Dad Joke of the Month

What did the paper clip say to the magnet on Valentine’s Day? I’m stuck on you!

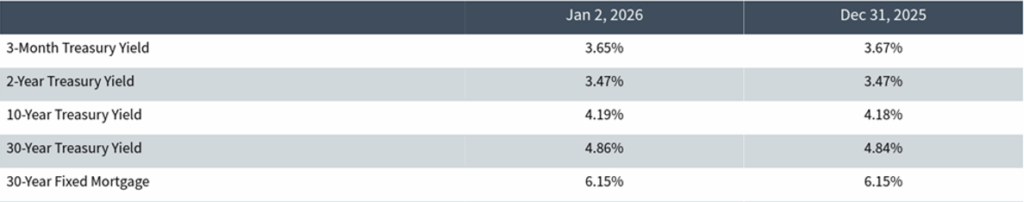

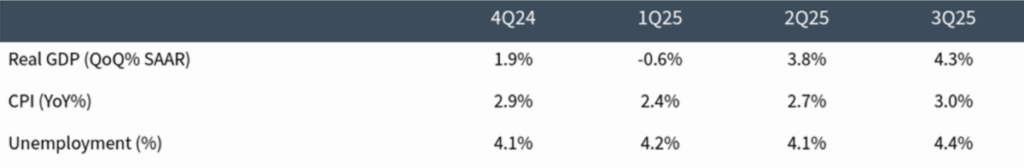

Market and Economic Data Update

Data just below is as of January 5th, 2026

Source: Clearnomics

Chart of the Month