Welcome to 2026!

If you know someone who let gloomy forecasts shake their confidence last year, here’s a bright twist: 2025 turned out to be a surprisingly rewarding year for many investors.

At the start of last year, headlines were dominated by recession warnings, lofty valuation fears, and doomsday calls from many analysts. Markets looked “treacherous,” and it seemed plenty of experts expected the worst. A brief pullback early in 2025 only added fuel to the fear.

But fast forward to today, those dire predictions didn’t play out the way many expected for the year as a whole.

The S&P 500 delivered solid gains, corporate earnings showed resilience, and the economy navigated bumps with more strength than many had forecasted. Furthermore, our equity models participated well in the gains the markets offered and many of our more growth-seeking clients were rewarded for this.

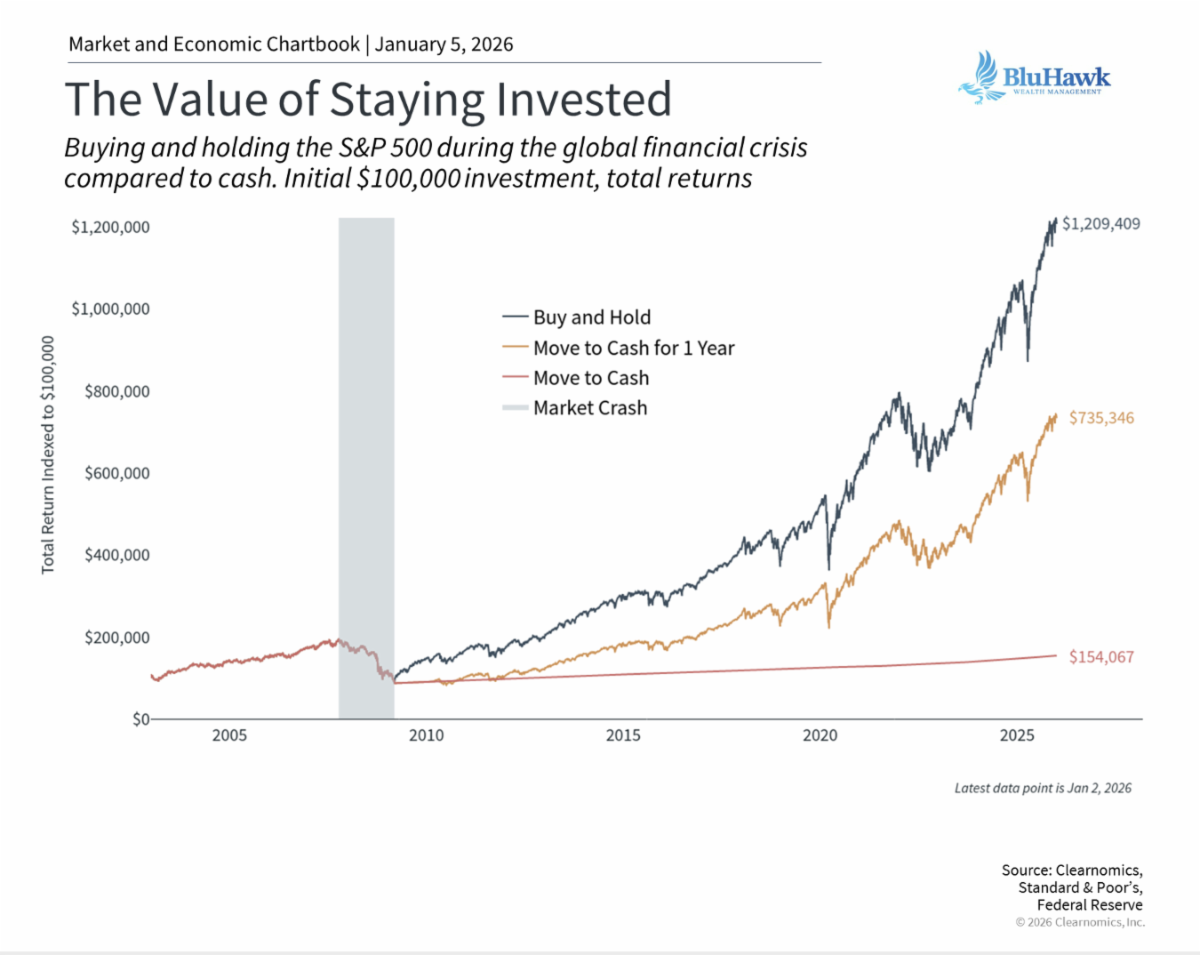

This kind of outcome reminds us of a timeless investing lesson: you don’t need perfect predictions to succeed, rather you just need mostly to stay invested.

The investors who benefited meaningfully in 2025 weren’t market timers; they were disciplined, long-term participants who trusted their plan and stayed the course.

At BluHawk Wealth Management, we don’t chase sensational market calls or try to outguess every headline. We do our best to focus on you, your goals, your timeline, your comfort with risk, balanced with your personal desire for potential opportunity. That’s where real confidence is built, not in tomorrow’s forecast.

Every client has a unique financial fingerprint: different income needs, time horizons, and life goals.

Our first priority is understanding you, not the latest “expert” prediction.

From there, we design a disciplined strategy that aligns your portfolio with your real-world needs. We strive to separate near-term income from long-term growth, seek to protect what you’ll rely on tomorrow, and position you to capture potential opportunity over time. This balanced “bucketing/segmenting” approach helps you stay steadier when markets wobble (which they always do) and focused on what matters most.

The truth is simple: volatility is normal, headlines are noisy, but a thoughtful plan endures over time. 2025 was a great reminder that staying committed through uncertainty tends to pay off more than reacting to fear, from wherever it may originate.

So, for 2026, here’s to the potential for another year of tuning out the incredible noise and sorting out and striving to hear the beautiful music that really matters, the well-played symphony of your best financial future.

Dad Joke of the Month

What do you call a fear of New Year’s songs? Ole Lang-xiety!

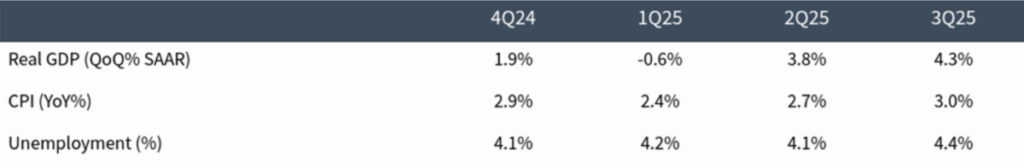

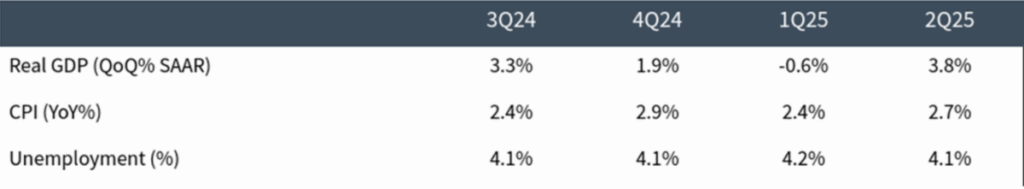

Market and Economic Data Update

Data just below is as of January 5th, 2026

Source: Clearnomics

Chart of the Month