Fall is officially here, and you can feel it: the air has cooled, leaves are turning into nature’s most dramatic color palette, and we’ve swapped our iced coffees for something warmer. Football season is barreling toward its midseason stretch, with contenders separating themselves from pretenders on every Sunday, or Saturday if you’re a college fan!

It’s also the season of thankfulness, when we pause, reflect, and acknowledge what matters most. But as we cozy up with our sweaters and tailgate snacks, there’s one ongoing disruption we can’t ignore: the federal government remains in shutdown (as of this writing… arrrggh).

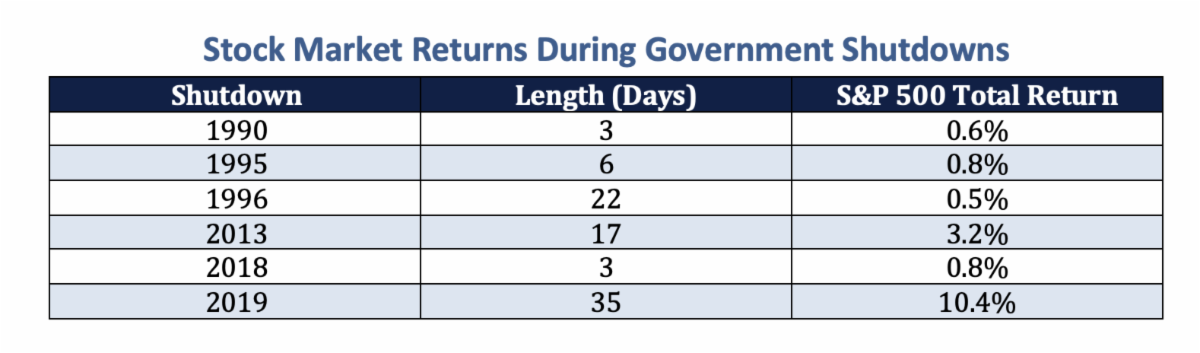

From the market’s perspective, shutdowns often attract more headlines than harm. Historically, the S&P 500 has tended toward modest moves during shutdowns, returns have ranged fairly evenly between slight gains and slight losses. In fact, during the famous 35-day shutdown of 2018–19, the S&P actually rose about 10.3%. Still, volatility creeps in as uncertainty grows, data releases get delayed, and sentiment can snap to “wait-and-see.” (Past performance being no guarantee).

But behind the charts are very real human costs, especially for the tens (or hundreds) of thousands of federal employees and contractors who have been furloughed or are currently working without pay.

Their mortgages, groceries, healthcare plans, schooling, these are not abstract line items. At BluHawk, we truly empathize: worry and financial strain in one corner of the economy ripple out to all of us. As we write this, many are waiting for clarity on when paychecks resume or when back-pay will be delivered.

So as November unfolds, we’ll navigate these autumn winds with fresh portfolio insights, timely planning ideas, and a meaningful focus on the people affected. Together, we can stay grounded in perspective, stay disciplined in our approach, and do right by those who are hurting while keeping our eyes on the horizon.

Let’s fall in, be thankful, and lean into the work this month.

Dad Joke of the Month

What do you get when you cross a turkey with a centipede? Drumsticks for everyone!

Market and Economic Data Update

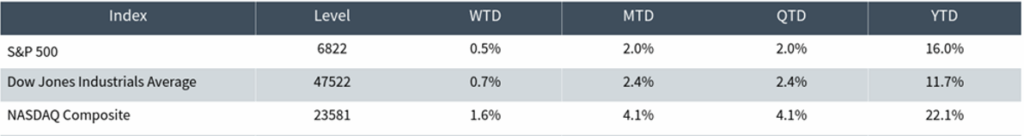

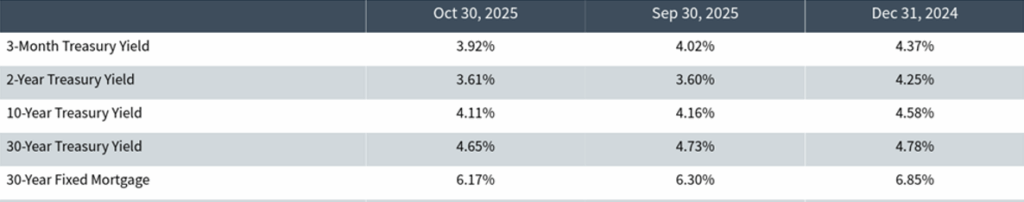

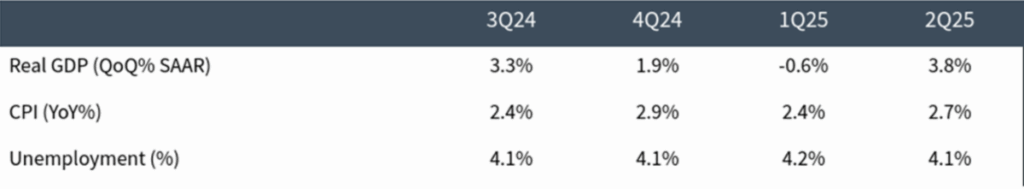

Data just below is as of October 30, 2025

Source: Clearnomics

Chart of the Month

*Data courtesy of Russell Investments (past performance is no guarantee)