With most of the year now behind us, I’d like to offer a few insights into the investment and financial landscape; what follows is information you don’t always hear on the national evening news or especially your perennially nervous neighbor….

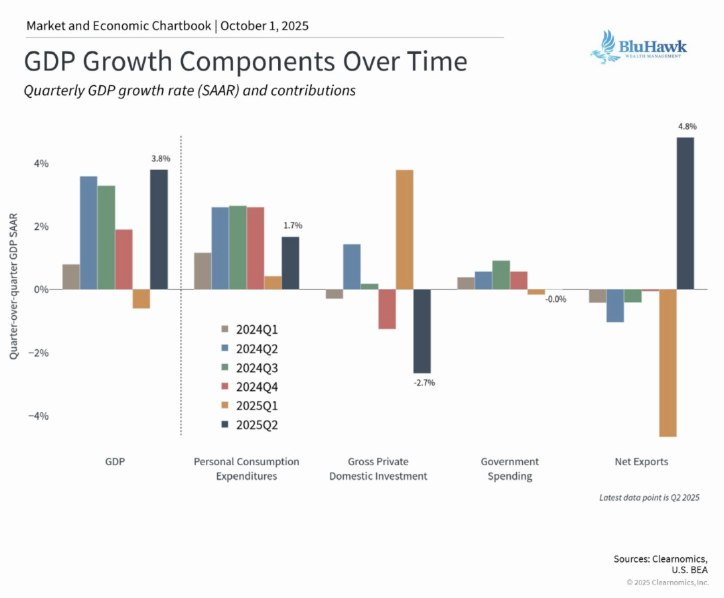

Growth is perhaps slowing a bit, but the economy isn’t crashing. Forecasters, including the Philadelphia Fed’s Survey of Professional Forecasters, expect real U.S. GDP growth to average about 1.7% in 2025, up a bit from earlier estimates. Our feeling is that it will be higher even than that.

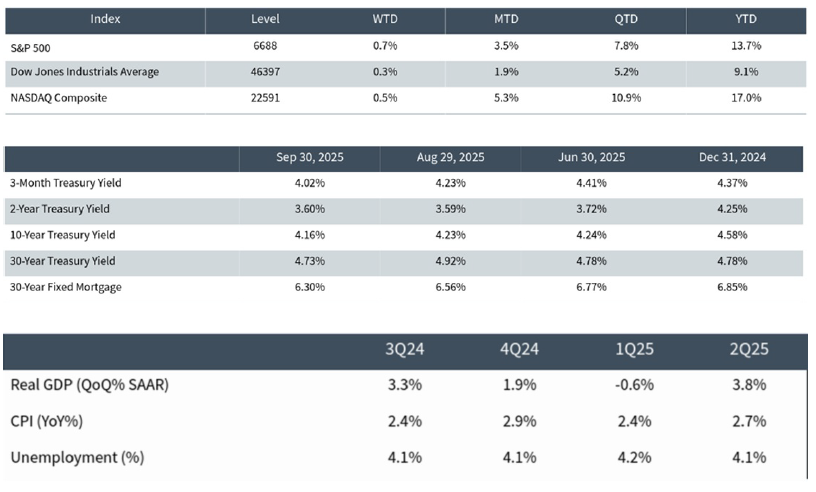

Unemployment is expected to continue to rise modestly, settling around 4.2% by year-end, higher than recent years, but still far from recessionary levels.

Inflation remains stubbornly (yet somewhat mildly) above the Fed’s target. Headline CPI is around 2.9%, and core measures are also elevated. But the trend is edging in the right direction: price pressures are easing slightly, supply chain dynamics are improving, and inflation expectations seem relatively well anchored.

Credit markets and interest rates are telling a consistent story: borrowing costs are still elevated, but recent moves, including the Fed’s first rate cut of the year to 4.00–4.25% on Sept 17, signal a willingness to ease as data allows. Meanwhile, credit spreads remain cautious, but markets do not appear panicked, suggesting risk is priced in, not overpriced.

Putting all this together, the Analytics Team at BHWM feels increasingly confident in the potential for a “soft landing” scenario.

We believe growth will be decent, inflation will gradually fall, unemployment rise gently, and interest rates drift lower as the Fed gains more comfort that inflation is under control. Of course, these assessments depend on the absence of a sudden shock or the dreaded unforeseen global negative event.

This path may not be free of bumps, but the data / experienced judgement combo suggests there is potentially more upside than downside from here if we stay alert, nimble, and grounded in evidence. “Don’t fight the Fed,” is what’s been said!

As always, thank you for reading, and for your business, and enjoy the fall colors!

Dad Joke of the Month

Why don’t skeletons fight each other? Because they don’t have the guts!

Market and Economic Data Update

Data just below is as of September 30, 2025

Source: Clearnomics

Chart of the Month