As the last golden rays of summer fade into crisp autumn air, we’re about to swap sandy toes for crunchy leaves, and embrace the spectacle of changing seasons. Also, football season is back, pumpkin‑spice is in the air, and even our clients’ pups seem to sense the shift, curling up in sweaters, snoozing in the sun, or eyeing the scarf closet with suspicious intent.

Speaking of pups, this month we’re featuring two exceptionally charming doggos sent in by our wonderful friends and clients, Kay and Rick. Meet Molly (8 1/2 years) and Malachi (1 1/2 years), blissfully “glamping” as they accompanied their retired “parents” on a long trip to enjoy the great outdoors in the cooler climes of The Upper Peninsula of Michigan while visiting family.

As we transition into this new season, it’s also the perfect time to take stock of your financial leaves and branches.

We’ve completed many reviews thus far in 2025, however, if you are one of the few we have not connected “live” with yet, we encourage a year‑end check‑up to review your investment or financial/retirement/tax planning strategy to ensure we’re on target for those long‑term goals.

For those approaching or in retirement, now’s the moment to fine‑tune your income planning and investment segmenting analysis, to strive to make the most of cash flow, tax brackets, and potential market opportunity.

Here’s to autumn air, football scores, playful pups, and planning that puts you ahead.

Enjoy this issue of the BluHawk Wealth monthly catch‑up, where warmth, wisdom, and wagging tails meet financial insight. A quick ZOOM call is available as may be needed and aligns with your goals and interests, and is just a scheduling click away!

Dad Joke of the Month

Why did the kid bring a ladder to school? Because he wanted to go to High School!

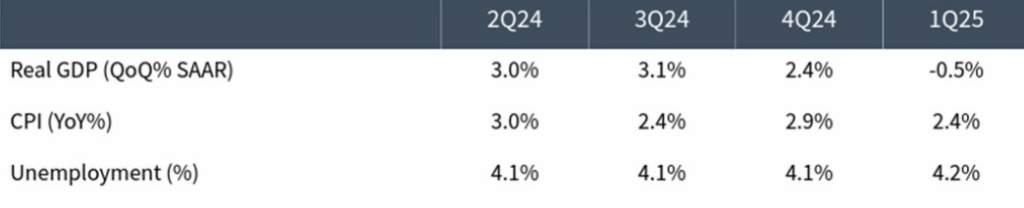

Market and Economic Data Update

Data just below is as of September 4, 2025

Source: Clearnomics

Idea of the Month

Here are 5 concise, actionable year-end financial planning and housekeeping ideas—perfect for BluHawk Wealth Management clients heading into Fall 2025.

Many of these steps have been discussed and completed throughout the year for our most engaged clients. They are especially tailored to set you up for a smooth end-of-year transition and strong start to 2026.

- Optimize your tax-advantaged contributions and withholding. Review and adjust your tax withholdings, especially if you’ve had income changes or bonuses, to avoid surprises come tax season. Max out contributions to your HSAs, FSAs, and employer-sponsored retirement accounts before year-end—these can meaningfully reduce taxable income.

- Rebalance and realign your portfolio. Trim strong performers and rebalance into underweight areas to better realign with your target asset allocation. Conduct tax-loss harvesting in taxable accounts to offset your capital gains or reduce taxable income (within IRS limits).

- Maximize benefits and open enrollment. Leverage your company’s open enrollment period, reviewing elections for health, HSA/FSA, life, and disability insurance to ensure coverage matches your current life stage. If you have any FSA balances, remember use‑it‑or‑lose‑it rules—plan medical or dependent care expenses before year-end.

- Clean up and prepare your financial foundation. Update your household financial statements: track your net income and net worth to measure progress and inform next year’s goals. Consolidate old (orphaned) retirement accounts (e.g., 401(k) from previous employers) into one rollover IRA for clarity and efficiency. Review estate planning documents, including beneficiaries, wills, and trusts, an often overlooked but critical piece of fall financial housekeeping.

- Strengthen your safety net and cash flow strategy. Evaluate your emergency fund—experts recommend having a buffer covering 6–12 months of living expenses amid ongoing economic uncertainties. Scrutinize spending habits and subscriptions, trimming non-essential costs and improving your ready cash flow.